Market and Business Intelligence

Replace assumptions

with evidence

Intelligence services and an AI agent for market monitoring, signals and competitive intelligence.

AI powered market intelligence, delivered where your team already works

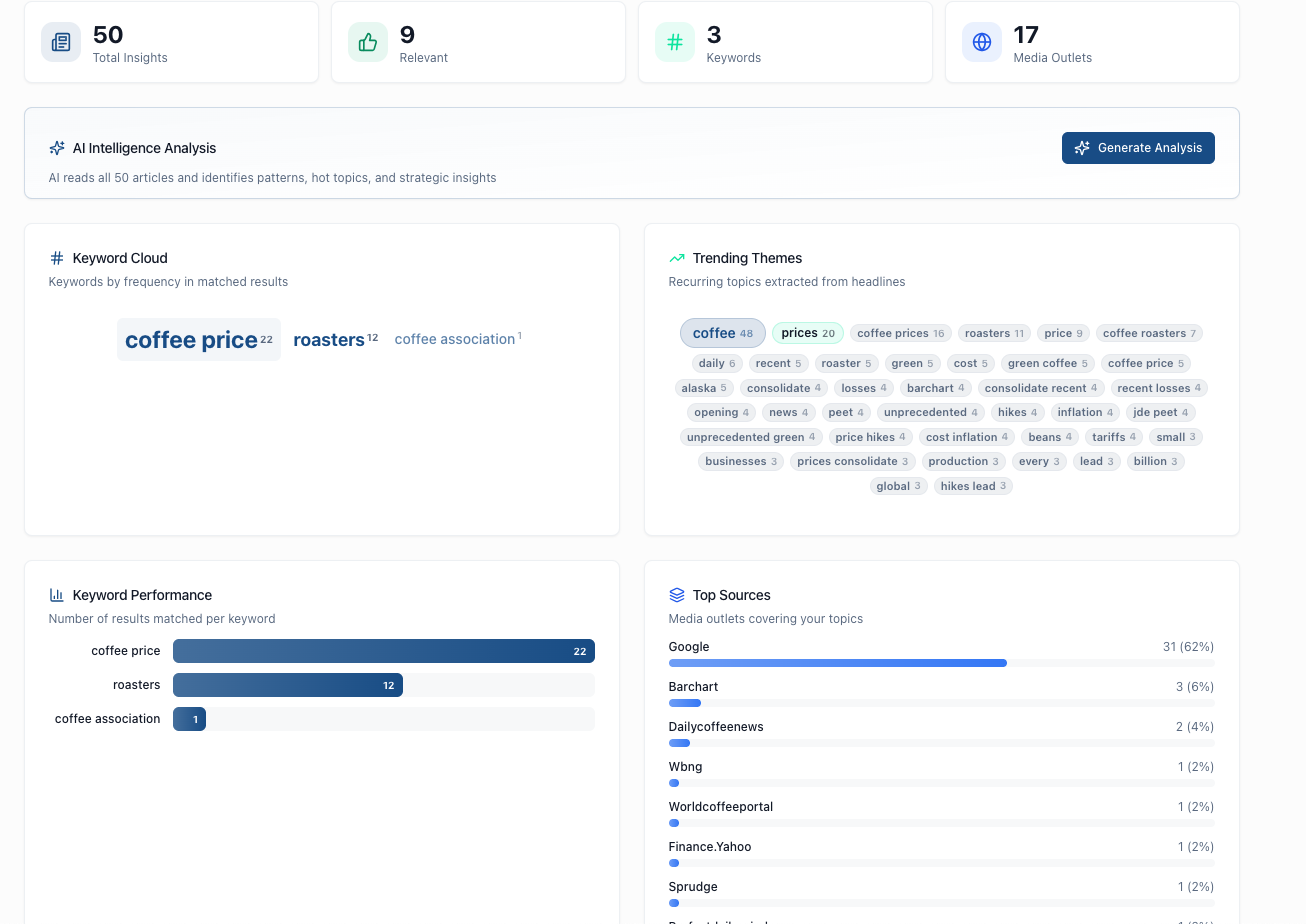

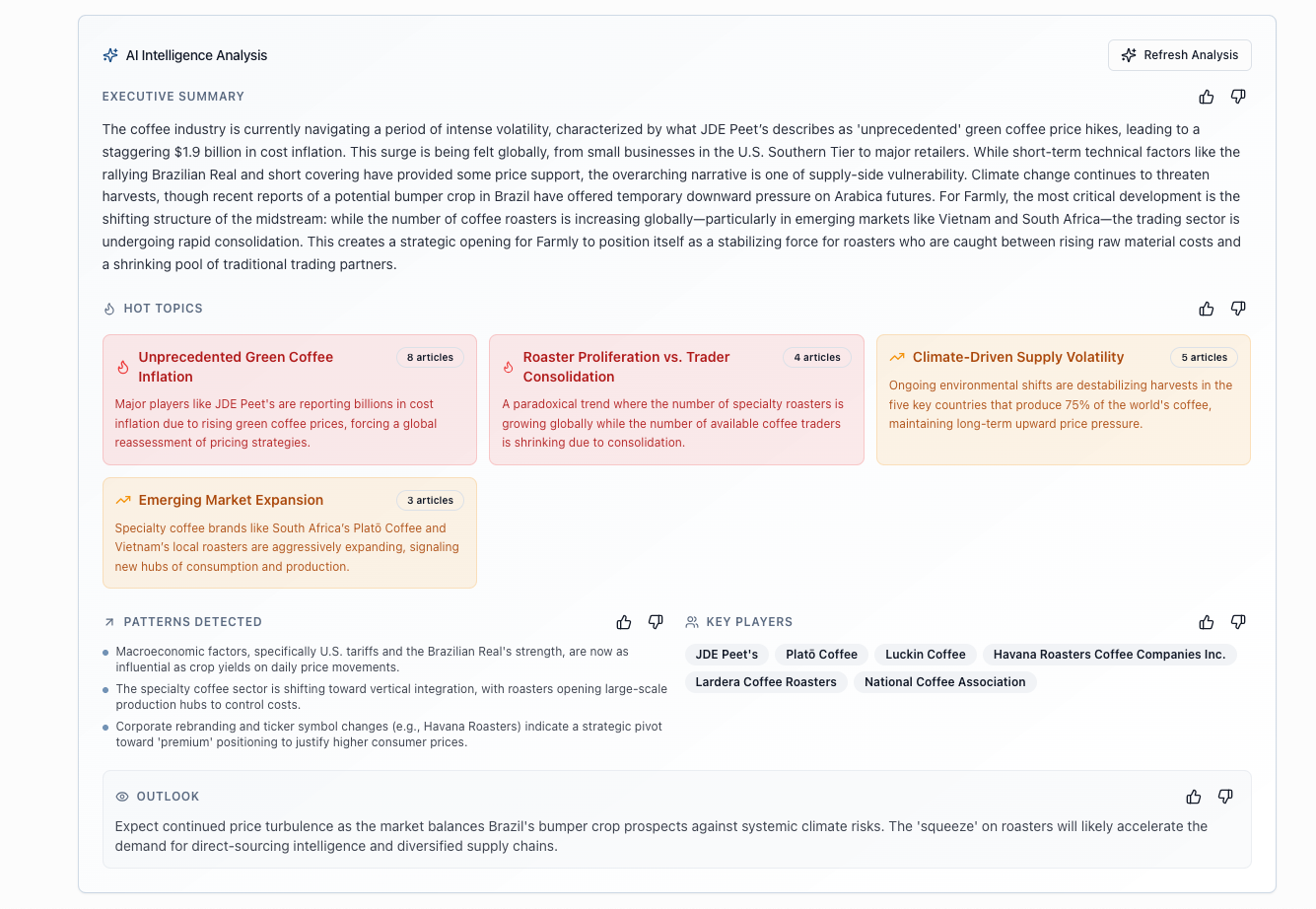

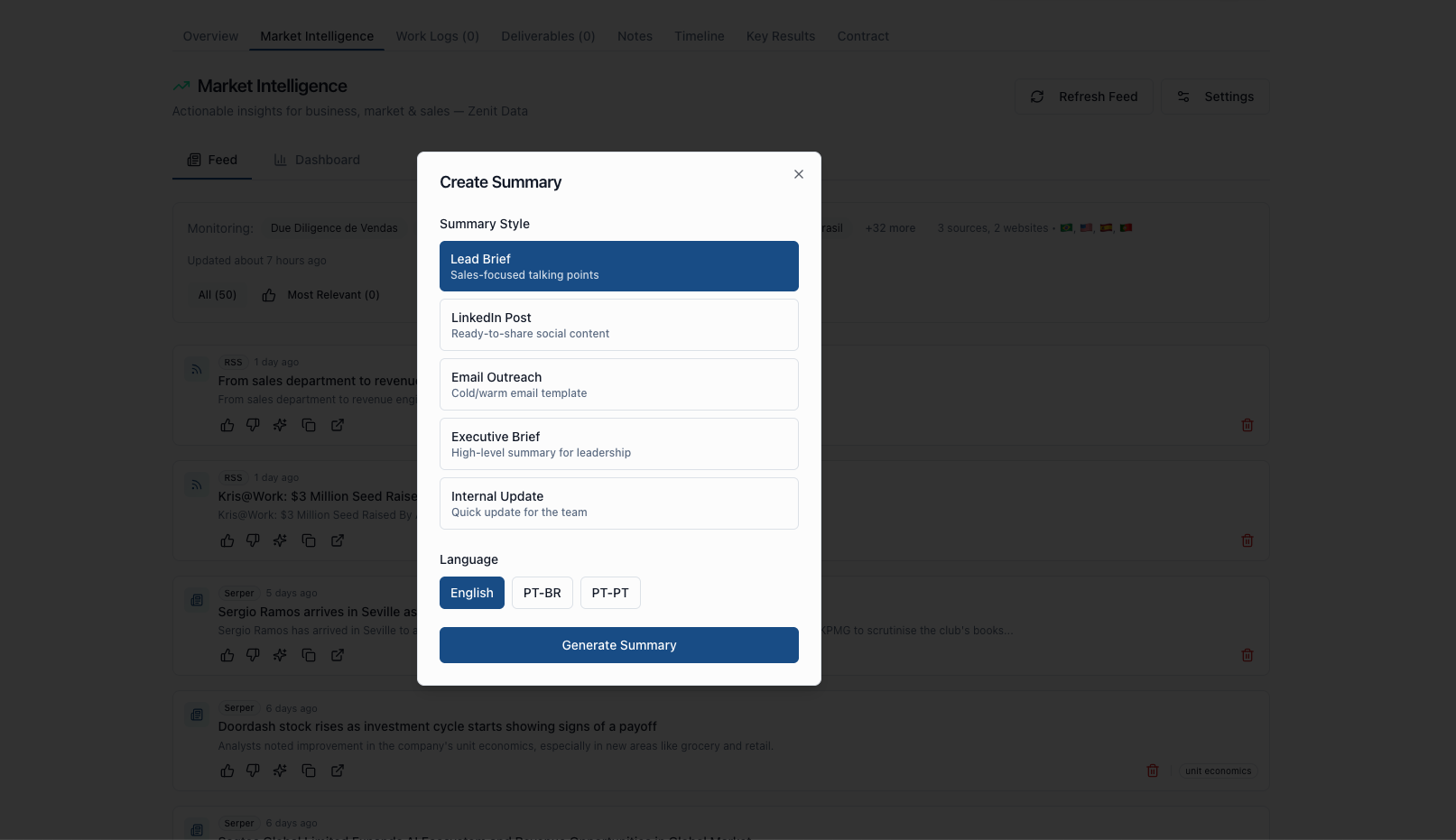

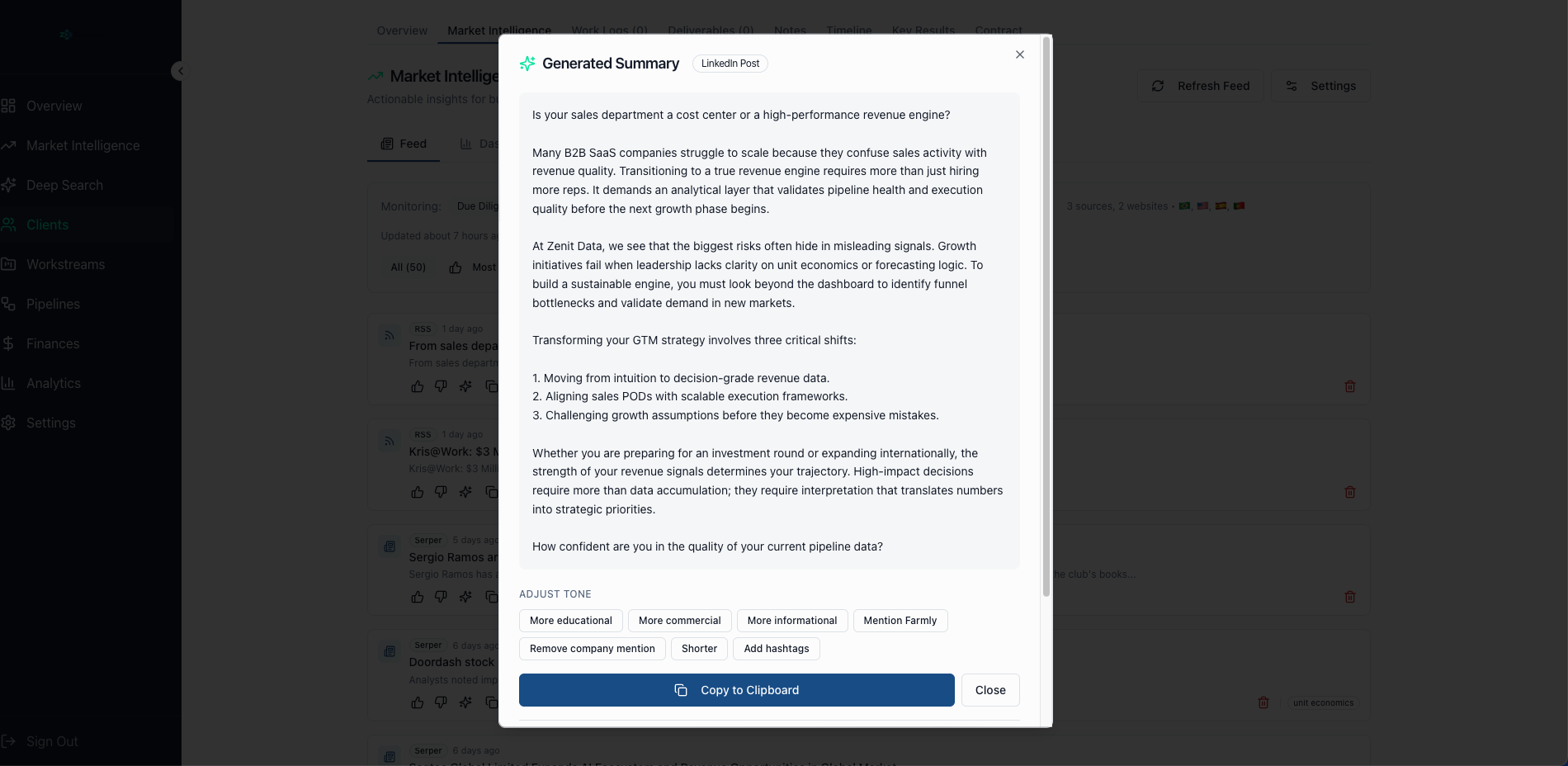

Continuous monitoring turned into structured signals, briefings and dashboards. Get the insights in Slack, WhatsApp, Telegram, email or internal platforms — at the frequency you choose.

Turn continuous monitoring into actionable insights

Generate structured AI analysis, create executive briefings, and connect insights to key accounts and live deals.

Stop guessing. Start knowing

We help organizations understand markets before making strategic moves: expansion, pricing changes, repositioning, or new product entry.

Market Sizing and Opportunity Assessment

We quantify markets using real customer economics, not inflated top-down numbers. So you invest in the right bets.

Demand Validation and Early Traction Analysis

We test whether demand is real before you scale or enter. Evidence-based go / no-go, not gut feel.

Customer, Segment and ICP Prioritization

We identify where growth actually comes from. Who to pursue, who to deprioritize, and why it matters now.

Competitive Landscape and Benchmarking

We map how markets truly compete, beyond surface-level positioning. So you know exactly where you stand and where to move.

International Market and Country Assessments

We support expansion decisions with grounded, local-aware analysis. No generic country profiles. Real signal for real decisions.

Pricing, Willingness-to-Pay and Elasticity Analysis

We bring evidence to pricing decisions. Know what your market will actually pay, what competitors charge, and where you are leaving money on the table. Includes mystery shopping and competitor pricing audits.

Every engagement is scoped around your specific question and timeline.

See what's really driving

your revenue.

We help leadership teams understand how revenue actually behaves, where growth is fragile, and what the numbers are not saying.

Revenue Performance and Predictability

Clarity on what is really driving results and where growth is fragile. Pipeline quality, conversion, velocity and revenue risk.

Unit Economics and Benchmarking

Structure and context to financial performance. Value creation, margin sustainability and how you compare against relevant peers.

Executive Dashboards and Ongoing Insights

Analytics translated into tools leaders actually use. Dashboards and reporting layers that support decisions, not vanity metrics.

Forecast, Sales, Marketing and CS Performance

Full-funnel visibility across all revenue-generating teams. Understand where leads convert, where they stall, and what each team is actually contributing to growth.

Delivered in the Tools You Already Use

Insights can be built in Power BI, Tableau, Looker or adapted to your existing setup, including spreadsheets when appropriate. No forced migrations.

See how a live revenue dashboard looks in practice.

Prepared companies

get better outcomes

We work with founders and leadership teams well before a transaction is on the table. Strengthening the thesis, exposing weaknesses early and aligning market, revenue and positioning with what investors will actually test.

Most companies start thinking about M&A or fundraising too late. By then, the narrative is rushed, the gaps are visible and the leverage is gone. We start 12 to 24 months before the event so you arrive prepared, not reactive.

Strategic Thesis

We help leadership teams clarify the strategic and investment story that will be tested by investors or buyers. Positioning logic, strategic options, timing and preparation of the investment or exit narrative.

Revenue Analysis

We assess whether revenue and product performance truly support a future transaction. Revenue quality, pipeline reliability, product and segment trends, growth dynamics and scalability risks.

M&A Sourcing

We identify and prioritize the right counterparties for fundraising, partnerships or future M&A conversations. Buyers, strategic partners, VC and PE funds, and grant opportunities aligned to your thesis.

Deals Context

We position the company in its real transaction landscape with comparable deals and market appetite signals. Valuation benchmarks, investor sentiment and market appetite summaries to support decision timing.

Preparing for fundraising or exit

We help you build a story that holds up under investor scrutiny, not just one that sounds good internally.

Strengthening the numbers before they are tested

Revenue quality, unit economics and pipeline reliability reviewed before a buyer or investor does it for you.

Market intelligence for portfolio companies

We support portfolio companies with market positioning, competitive intelligence and deal context to maximize exit value.

This work starts well before the transaction. The earlier, the better.

Projects delivered across key international markets. And ready for more