Background

Between 2022 and 2023, a mid-sized SaaS company with a diversified product portfolio faced increasing operational complexity and declining efficiency in part of its business. While one product line remained profitable, it required disproportionate operational effort, legacy infrastructure and management attention, limiting the company’s ability to scale its core strategic businesses.

The company engaged Zenit to conduct a deep strategic and financial analysis of its portfolio and evaluate structural alternatives, including M&A scenarios, divestment options and capital reallocation strategies.

Objectives

The primary objectives of this engagement were to:

-

Assess the real economic performance of each business line

-

Identify structural risks related to cost, churn and revenue concentration

-

Evaluate strategic fit between products and long-term company vision

-

Explore M&A and divestment scenarios for non-core assets

-

Recommend a path to strengthen cash generation and strategic focus

Approach

Zenit’s approach combined revenue analytics, portfolio analysis and strategic scenario modeling:

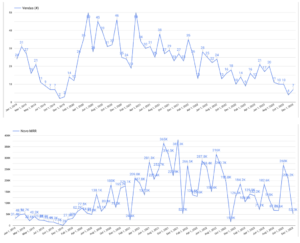

1. Portfolio & Revenue Structure Analysis

Objective: Understand revenue concentration, margin sustainability and operational burden across products.

Method: Analyse MRR distribution, customer concentration, churn dynamics, contract structure and cost allocation.

Outcome: Identification of a product line with high revenue concentration, elevated operational costs and structural scalability constraints.

2. Strategic Fit & Risk Assessment

Objective: Evaluate whether the product aligned with the company’s long-term strategy.

Method: Assess roadmap feasibility, infrastructure constraints, customer satisfaction indicators and internal execution capacity.

Outcome: Clear evidence that the product was consuming capital and management attention disproportionate to its strategic value.

3. M&A and Divestment Scenarios

Objective: Identify alternatives to value destruction or prolonged inefficiency.

Method: Model scenarios including full portfolio sale, partial divestment, operational handover and royalty-based structures.

Outcome: Recommendation to divest the portfolio and reallocate capital and focus to higher-growth, strategically aligned businesses.

Results

The company executed the recommended divestment strategy and restructured its portfolio accordingly. Within the following 12 months:

-

Strong Cash Generation: The divestment unlocked significant cash flow, strengthening financial resilience.

-

Strategic Focus: Leadership redirected resources to core businesses with clearer growth trajectories.

-

Operational Simplification: Reduced complexity across product, infrastructure and customer support operations.

-

Improved Decision Velocity: Management attention shifted from legacy issues to growth and execution.

Conclusion

This engagement exemplifies Zenit’s ability to support high-impact strategic decisions beyond incremental optimization. By combining deep revenue analytics with M&A logic and strategic clarity, Zenit helped the client make a bold portfolio decision that materially improved cash generation, focus and long-term positioning.

The case demonstrates how data-driven portfolio management and disciplined divestment can be as critical to growth as acquisition or expansion.