Market Intelligence, Market Research, and Business Intelligence are used loosely in most executive teams, the terms . They sound similar. They often sit in adjacent departments. They sometimes even share tools. Yet structurally, they serve different purposes, operate on different time horizons, and answer different strategic questions.

The confusion between them does not create small inefficiencies. It creates strategic blind spots.

In 2026, markets shift faster, categories fragment more quickly, procurement processes are more complex, and AI amplifies both signal and noise. In that environment, knowing what each discipline actually does is not semantic precision. It is a competitive necessity.

What Is Business Intelligence (BI)?

Business Intelligence is fundamentally inward-facing. It transforms internal data into dashboards, reports, and predictive insights that support operational decision-making.

IBM defines Business Intelligence as the processes and technologies used to collect, integrate, analyze, and present business information in order to support better decisions (https://www.ibm.com/think/topics/business-intelligence). BI answers questions such as revenue trends, conversion dynamics, churn patterns, and cohort economics.

TechTarget reinforces that BI focuses on analyzing historical and current data to improve operational performance (https://www.techtarget.com/searchbusinessanalytics/definition/business-intelligence-BI). That definition clarifies BI’s boundary: it reveals internal reality with precision, but it does not independently interpret external structural shifts.

BI can show that pipeline velocity declined. It cannot, on its own, determine whether the cause was competitor repositioning, category saturation, regulatory change, or buyer expectation shifts. BI is necessary for execution. It is insufficient for market interpretation.

What Is Market Research?

Market Research is methodological and typically project-based. It relies on structured data collection methods such as surveys, interviews, focus groups, and concept testing to answer specific questions.

Cision explains that Market Research focuses on collecting and analyzing data about consumers and markets to answer defined business questions (https://www.cision.com/resources/insights/market-intelligence-vs-market-research/). It is powerful when the organization needs validation. It clarifies willingness-to-pay, message clarity, segment preferences, and feature prioritization.

However, Market Research measures responses. It does not model systems. It does not inherently account for competitor incentives, distribution dynamics, switching costs, or regulatory shifts. When companies attempt to extract long-term strategic direction purely from research studies, they often gain precision on customer perception while missing structural market evolution.

Market Research reduces uncertainty about a question. It does not define the strategic landscape.

What Is Market Intelligence?

Market Intelligence is a continuous capability that synthesizes external signals into structured strategic interpretation.

Contify defines Market Intelligence as an ongoing process of gathering and analyzing external information to inform strategic decisions (https://www.contify.com/resources/blog/market-intelligence-vs-market-research/). Unlike Market Research, it is not episodic. Unlike Business Intelligence, it is not internally anchored.

Market Intelligence addresses broader structural questions. How is the category evolving? Who are emerging substitutes? How are pricing architectures shifting? What narrative is shaping buyer evaluation criteria? Where is value moving in the ecosystem?

Market Intelligence only exists if it changes decisions. If it does not influence positioning, segmentation, pricing logic, or roadmap prioritization, it is monitoring rather than intelligence.

Market Intelligence vs Competitive Intelligence

Competitive Intelligence is frequently confused with Market Intelligence. It represents a subset rather than the full system.

Investopedia defines Competitive Intelligence as the process of gathering and analyzing information about competitors to inform strategy (https://www.investopedia.com/terms/c/competitive-intelligence.asp). The Society of Competitive Intelligence Professionals emphasizes structured and ethical analysis of competitor information (https://www.scip.org/page/Competitive-Intelligence-Foundational-Tools-and-Practices).

Competitive Intelligence focuses on competitors. Market Intelligence incorporates competitors but extends further to include buyer constraints, substitutes, channel structures, macroeconomic signals, and regulatory dynamics.

If removing competitor names collapses your analysis, you are likely conducting Competitive Intelligence. Market Intelligence requires a system view of the entire market architecture.

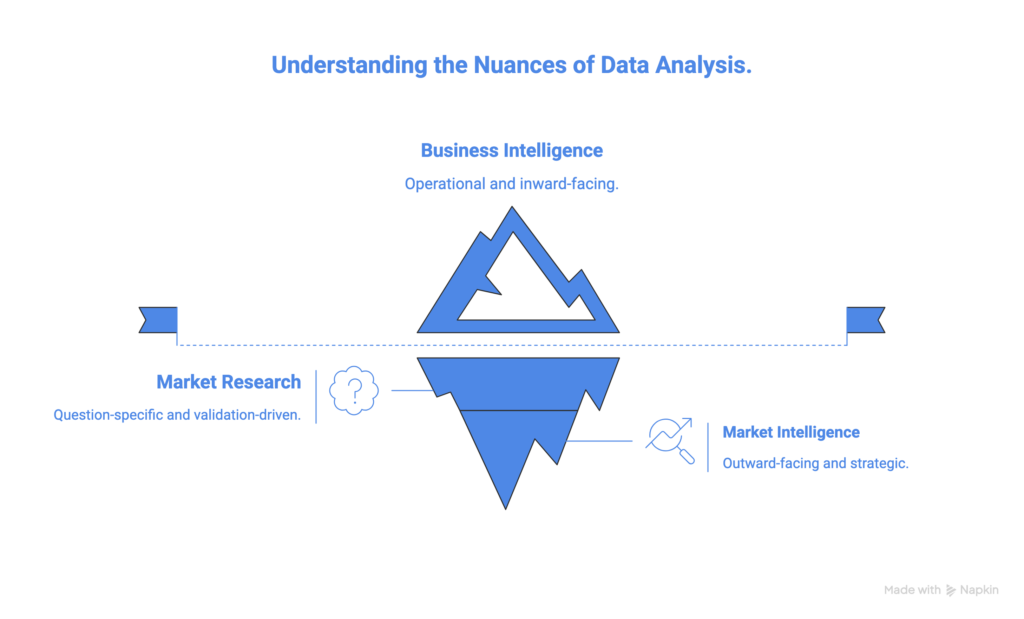

Structural Differences at a Glance

Business Intelligence is inward-facing and operational.

Market Research is question-specific and validation-driven.

Market Intelligence is outward-facing and strategic.

Business Intelligence optimizes execution.

Market Research validates assumptions.

Market Intelligence shapes direction.

Each discipline has value. Confusing them weakens all three.

Why Organizations Get This Wrong

Organizations often privilege what is measurable and tool-based. BI produces dashboards. MR produces reports. MI produces synthesis and interpretation, which require judgment.

Because Market Intelligence is interpretive, it demands stronger strategic ownership. It cannot be reduced to software alone. Without a defined decision cadence and executive accountability, MI becomes fragmented monitoring rather than structured guidance.

The result is common: operational optimization while strategic positioning erodes.

A Decision-First Framework

The correct intelligence mix depends on the decision at hand.

If the organization is redesigning pricing, Market Research measures willingness-to-pay sensitivity. Business Intelligence analyzes churn, expansion, and plan performance. Market Intelligence evaluates competitor monetization logic and category pricing trends.

If the decision concerns market entry, Market Research clarifies customer expectations. Business Intelligence reviews analogous historical performance. Market Intelligence maps incumbent positioning, adoption friction, and ecosystem constraints.

If the decision concerns repositioning, Market Research tests clarity and resonance. Business Intelligence analyzes funnel dynamics. Market Intelligence evaluates category narratives and substitute positioning.

Strategic clarity emerges when the correct tool is matched to the correct decision layer.

The Intelligence Loop Model

High-performing companies integrate the three disciplines into a loop.

Market Intelligence frames the external environment and identifies structural shifts.

Market Research validates specific hypotheses within that landscape.

Business Intelligence measures execution outcomes and performance impact.

Insights from execution feed back into the next strategic framing. The loop repeats.

This creates adaptive capacity rather than static reporting.

The Role of AI in 2026

AI enhances speed and breadth of synthesis. It scans documents, clusters themes, and retrieves patterns across large datasets. It lowers the time cost of analysis.

It does not replace strategic framing. It does not determine which trade-offs align with long-term positioning. It does not assume accountability for decisions.

AI strengthens intelligence only when embedded within a structured decision model.

A Strategic Self-Assessment

Ask a single question. In the past quarter, did your intelligence efforts materially change a strategic decision? If the answer is no, you likely have reporting, research, or monitoring. You may not yet have Market Intelligence as a capability.

In modern markets, competitive advantage comes not from possessing more data, but from interpreting structural shifts faster and acting decisively. Understanding the difference between Business Intelligence, Market Research, and Market Intelligence is the foundation of that capability.

FAQ

What is the difference between Market Intelligence and Market Research?

Market Research is project-based and designed to answer specific questions through structured methodologies such as surveys and interviews. Market Intelligence is continuous and synthesizes multiple external signals to inform strategic decisions. Source: https://www.cision.com/resources/insights/market-intelligence-vs-market-research/

What is the difference between Market Intelligence and Business Intelligence?

Business Intelligence focuses on internal performance data and operational reporting. Market Intelligence focuses on external market dynamics and strategic implications. Sources: https://www.ibm.com/think/topics/business-intelligence and https://www.techtarget.com/searchbusinessanalytics/definition/business-intelligence-BI

Is Competitive Intelligence the same as Market Intelligence?

Competitive Intelligence focuses primarily on analyzing competitors. Market Intelligence is broader and includes buyers, substitutes, channel dynamics, regulatory signals, and structural category shifts. Source: https://www.investopedia.com/terms/c/competitive-intelligence.asp